New Delhi: Many stock traders focus primarily on technical analysis, which involves studying the volume and price movements of stocks. These movements are influenced by factors like supply and demand for the company’s shares and overall market sentiment, alongside fundamental analysis. Traders use various tools and methods to perform this kind of technical analysis on the stocks.

The central pivot range (CPR) is one of the most popular methods traders use to analyze stocks. In this article we talk about different kinds of CPR Indicators, giving useful hints to both beginners and experienced traders.

What is a CPR Indicator?

CPR stands for Central Pivot Range, and it’s a technical analysis tool that helps identify key price points for setting up trades. It’s useful for intraday trading and is commonly used to find the market’s potential levels of support and resistance. CPR is made up of three components: Pivot, Bottom Central Pivot (BC), and Top Central Pivot (TC).

These components are based on the previous day’s high, low, and close prices. CPR can help identify the S&R pattern, and it’s considered bullish if the current market price is higher than the TC line. It’s considered bearish if the current market price is below the BC line.

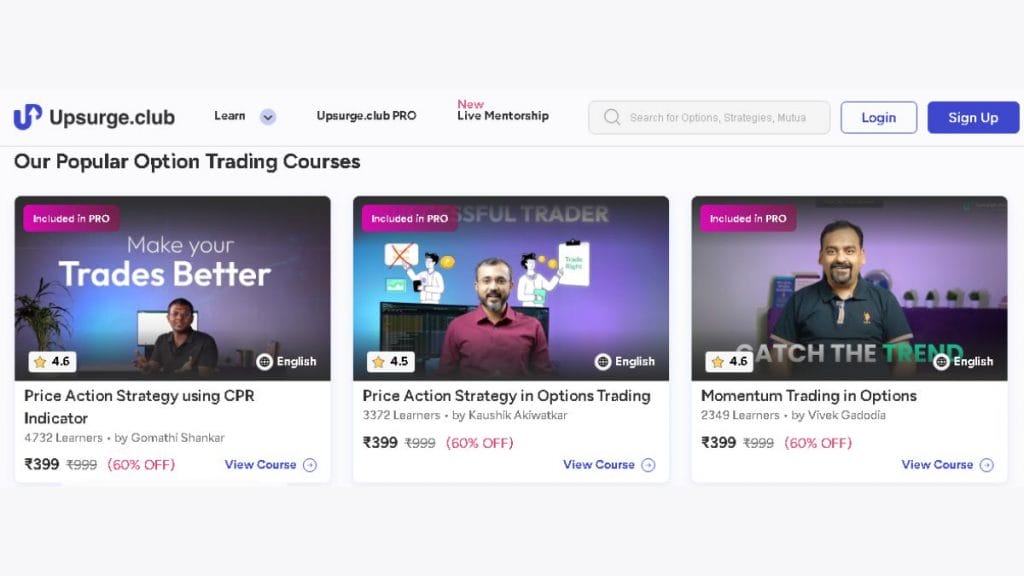

Traders use CPR to determine the levels at which they may want to enter or exit trades. It’s a popular price action strategy among traders because it’s quite versatile and simple to understand. Additionally, you can also take a price action course on Upsurge. club to further improve your understanding of market dynamics.

Types of CPR Indicators

The Central Pivot Range indicator has three levels:

1. Central Pivot Point (Pivot/PP)

The Central Pivot Point (Pivot/PP) is a key level in the Central Pivot Range indicator. It’s calculated as the average of the high, low, and closing prices from the previous trading session.

This level serves as a potential pivot or turning point for the price action. Traders use it to predict future price movements.

If the price is above the Pivot Point, the market is considered bullish, and if it’s below, the market is bearish.

2. Top Central Pivot (TC)

The Top Central Pivot is a crucial level in the Central Pivot Range indicator. It’s calculated by adding the difference between the high and low prices of the previous trading session to the Pivot Point.

The TC serves as a potential resistance level in the market. If the price crosses above the TC, it indicates a strong bullish trend, suggesting a good opportunity for buying.

Conversely, if the price fails to cross the TC, it could signal a potential downturn, indicating a selling opportunity. Traders use the TC to make informed trading decisions.

3. Bottom Central Pivot (BC)

Finally, the Bottom Central Pivot is an essential level in the Central Pivot Range indicator. It’s calculated by subtracting the difference between the high and low prices of the previous trading session from Pivot Point.

The BC serves as a potential support level in the market. If the price crosses below the BC, it indicates a strong bearish trend, suggesting a good opportunity for selling.

On the other hand, if the price bounces off the BC, it could signal a potential upturn, indicating a buying opportunity.

Conclusion

Understanding the Central Pivot Range (CPR) Indicator can significantly enhance your trading strategies. It’s a powerful tool that, when used correctly, can provide valuable insights into market trends. If you’re keen to delve deeper into this subject, consider enrolling in online option trading courses from Upsurge Club.