New Delhi: Investors commonly wonder whether to take the Systematic Investment Plan (SIP) route or make a lumpsum investment when investing in mutual funds. Both approaches have their own pros and cons, depending on individual financial goals, risk appetite, and market conditions.

This blog will help you understand the differences between SIPs and lumpsum investments so that you can decide which one may be more appropriate for your needs.

What is SIP Investment?

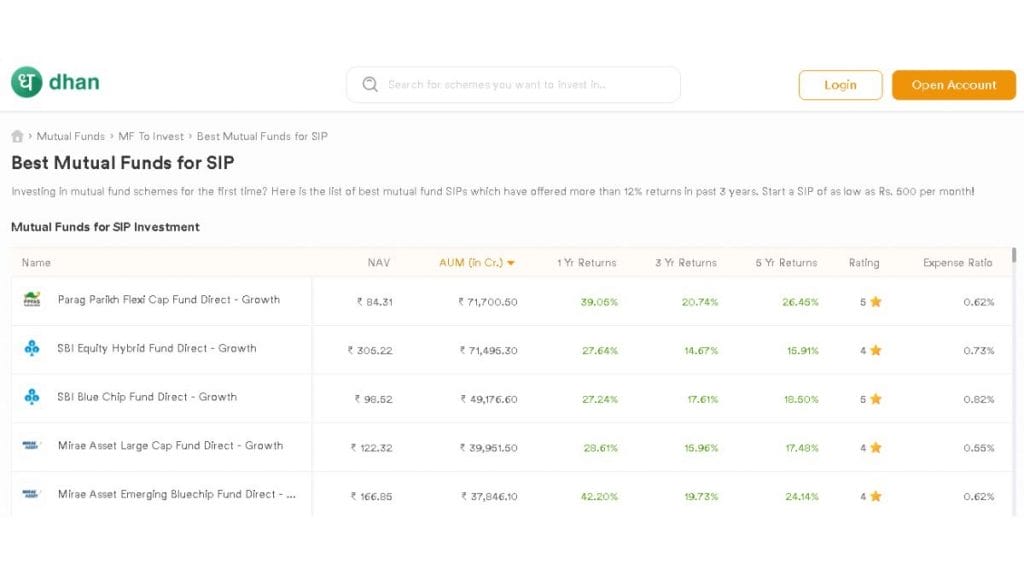

A systematic investment plan (SIP) involves regularly putting aside a certain amount of money in mutual funds, mostly monthly. It is like saving part of your salary every month. As time goes by, investors can create a substantial corpus by investing in the best mutual funds for SIP.

Advantages of SIP

Let’s look into the advantages of SIP investment:

1. Rupee Cost Averaging

Rupee cost averaging is one of the most significant advantages of SIPs. An investor invests a fixed sum regularly during market ups and downs to buy more units when markets are down, thus reducing unit costs but buys fewer units when markets go up, thereby increasing unit costs.

2. Disciplined Savings

By committing to monthly investment amounts, you ensure consistent savings towards your financial goals from your income, especially for those who can’t save easily otherwise. Also, SIPs are highly flexible. You only need to start with small amounts and gradually increase them as your income grows. In addition, you can pause or stop the SIP anytime without any penalties, making it a convenient way of investing.

3. Power of Compounding

Systematic Investment Plans (SIPs) tap into the power of compound interest by investing regularly over long periods of time. The returns earned on one’s investments are re-invested, which leads to exponential growth in the long run.

What is Lumpsum Investment?

On the other hand, investing an enormous amount of money at once in a mutual fund is known as a lumpsum investment. This is useful when large sums of money are available for investment, such as bonus payments, inheritance, or savings.

Advantages of Lumpsum Investments

Let’s look into the advantages of lumpsum investments:

- Beneficial During Market Lows

Big lumpsum investments do very well when made at market lows. By investing a large sum when the market is down, you purchase units at a lower price. As the market recovers, the value of your investment grows, potentially yielding higher returns.

2. Simplicity

Lumpsum investments are straightforward. You make just one investment once and needn’t worry about contributions every month, as is seen in regular premium policies for traditional insurance. This simplicity makes them attractive to people who would rather hand off their investments than stay involved in them all day long.

3. Immediate Exposure

With lumpsum investments, your entire investment amount is exposed to the market from the get-go. This immediate exposure can be advantageous in a rising market, where your money starts working for you right away.

SIP vs. Lump Sum: Which is Better?

Let’s see which one is better for you.

Risk Appetite:

Your risk appetite plays a crucial role in deciding between SIP and lumpsum investments. If you are risk-averse and prefer mitigating the impact of market volatility, SIPs might be more suitable. On the other hand, if you have a higher risk tolerance and can invest a significant sum during market lows, lumpsum investments can be more rewarding.

Financial Goals:

Consider your financial objectives and the time horizon for achieving them. SIPs are ideal for long-term goals such as retirement or children’s education, where you can benefit from rupee cost averaging and compounding. Lumpsum investments can be better suited for short to medium-term goals, provided you can time the market effectively.

Based on your preferences, you can make a call on which option to choose. Most mutual fund apps allow you to opt for any of these two options.

Conclusion:

Both SIP and lumpsum investments have their unique advantages and can play a vital role in a diversified investment portfolio. Your choice should depend on your financial goals, risk tolerance, and market outlook.