New Delhi: Approximately 50% of the total outstanding Rs 2,000 denomination notes in circulation as of March 31 have been returned to banks since May 19, according to Reserve Bank of India (RBI) Governor Shaktikanta Das. Out of the Rs 3.62 trillion worth of Rs 2,000 banknotes in circulation, around Rs 1.8 trillion has been deposited or exchanged. Das further stated that on a provisional basis, about 85% of the Rs 2,000 notes are being deposited into bank accounts, while the remaining are being exchanged at bank counters.

State Bank of India’s chief economist, Soumya Kanti Ghosh, highlighted that approximately 85% of the Rs 2,000 notes are being deposited into bank accounts rather than being exchanged for smaller denominations. This suggests that bank deposits are expected to increase by at least Rs 2 lakh crore, assuming that some of the notes were already with banks in currency chests.

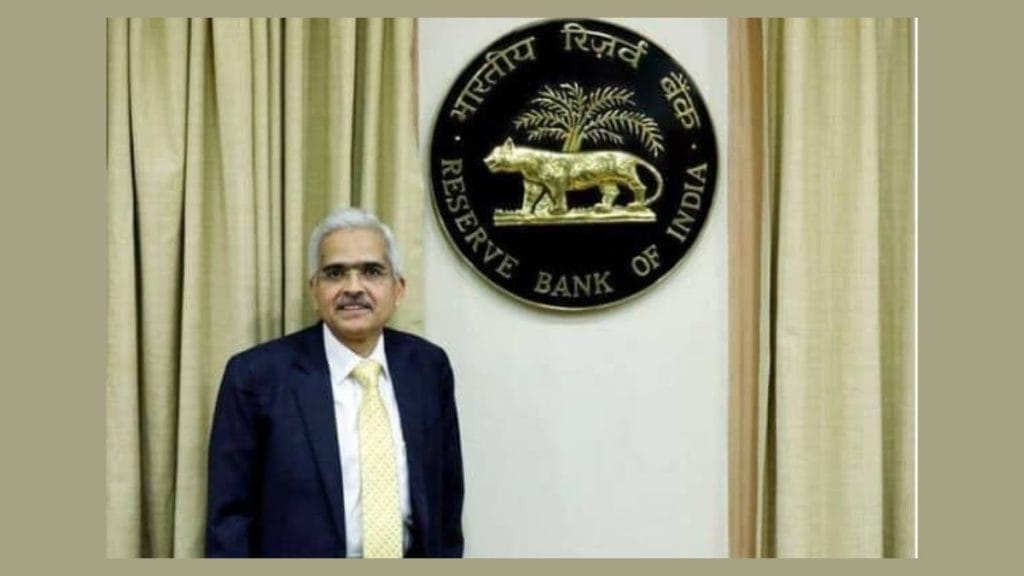

Governor Das expressed that the current trend aligns with the RBI’s expectations. He also noted that there had been no rush or panic among people to exchange or deposit money at banks. However, he urged the public not to rush or panic while visiting banks in the future.

Overall, the return of 50% of the Rs 2,000 notes to banks since the RBI’s withdrawal announcement indicates a significant reduction in the circulation of these high-denomination notes.