Mumbai: SBI General Insurance, a leading general insurance company, has unveiled a series of three brand films reiterating their core values of “Suraksha” (safety) aur “Bharosa” (trust) Dono. The film aims to boost awareness about insurance by portraying relatable real-life situations. By doing so, the brand seeks to establish a deeper and more meaningful connection with its audience, making the concept of insurance more accessible and relatable to people’s everyday lives.

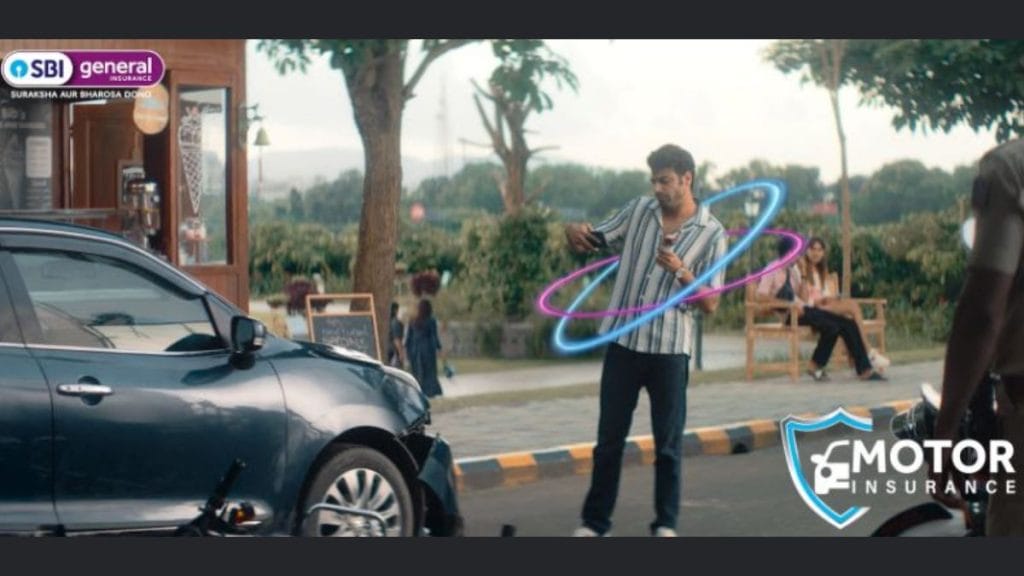

The brand film features a series of scenarios spanning various non-life insurance product categories, i.e., Motor, Health, and SME.

Through an interesting and engaging storytelling format, the films highlight the importance of being prepared for any unforeseen situations that could arise at any point of time in life. The brand film adopts a real-life, humorous tone to highlight these vital insights. E.g. the first Health film depicts a simple, carefree picnic day with your family, which could suddenly take a U-turn and escalate into an emergency with something as small as choking on a moong phali (peanut), while the second Motor film showcases that another person’s mistake can cause an accident with financial ramifications and the third SME film showcases how having insurance could give an individual a peace of mind even when one is faced with unexpected obstacles.

The objective of the film is to create awareness about SBI General’s diverse product range, catering to various age groups and market segments. This approach helps the audience relate to the scenarios and understand the importance of being adequately insured in different aspects of life.

Commenting on the brand film launch, Mr Rathin Lahiri, Head Marketing and CSR, SBI General Insurance, said, “Insurance is a complex category with low consumer penetration. Our brand communication aims to own the category benefits of protection and trust, which are the key benefits that the consumer is seeking from leading brands in this category. The insight behind the film is that unexpected situations can arise at any moment, and being prepared with the right insurance plan from a trusted brand can help you live your life with confidence. SBI General Insurance provides you ‘Suraksha aur Bharosa, ’ which lets you lead your life with confidence.”

The series of three ad films focuses on educating the audience on the benefits of being insured and the confidence that it gives the consumer and highlights the hassle-free claims process.

The campaign will be integrated across platforms, including digital media, television, and social media channels.

About SBI General Insurance Company Limited:

SBI General is one of the fastest-growing private general insurance companies, with the strong parentage of SBI. We at SBI General Insurance are committed to carrying forward the legacy of trust and security and have the vision to become the most trusted general insurer for a transforming India.

Ever since our establishment in 2009, our growth has been exponential in various aspects. We have expanded our presence from 17 branches in 2011 to over 141 branches pan-India. To date, we have served over 34 crore customers. We have been awarded ‘Insurer of the Year’ in the non-life category at the FICCI Insurance Industry Awards for two consecutive years in 2020 & 2021. In 2022, recognized as the ‘Best General Insurance Company of the Year’ at the ‘Third Emerging Asia Insurance Awards’ organized by the ‘Indian Chamber of Commerce’.

We have a robust multi-distribution model encompassing Bancassurance, Agency, Broking, Retail Direct Channels and Digital tie-ups. The widespread network of distributors like 22437 plus SBI branches, Agents, other financial alliances, OEMs, and multiple digital partners enable us to extend our reach to the pocketed remote areas of India. We offer a bouquet of products spread across various lines of businesses that cater to customers across all segments like Retail, Corporate, SME and Rural, ensuring accessibility via digital as well as physical modes.

SBI General Insurance reported a 17.6% growth in Gross Written Premium (GWP) in FY 2022-23, and the GWP stood at Rs. 10,888 crore.