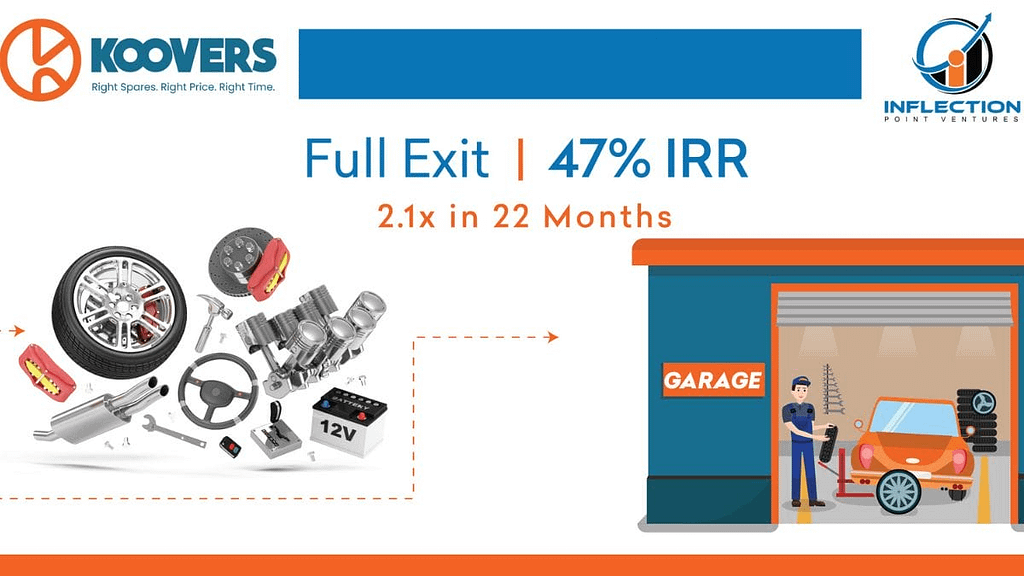

Delhi: Inflection Point Ventures, one of the most active angel platforms with over Rs 600 crore invested across 175+ startups, has announced a full exit from Koovers with 47% IRR. IPV has achieved 2.1X MoM from this exit within 22 months of investing in the Company.

This success underscores IPV’s strategic expertise in nurturing and guiding its portfolio companies to thrive in the competitive startup landscape. The exit comes at the back of Koovers acquisition by German automotive giant Schaeffler India for over Rs 142 crore.

- IPV has recorded 2.1X MoM in just 22 months of investing in Koovers

- Koovers is a B2B e-commerce platform providing genuine spare parts to independent auto-workshops and the aftermarket with doorstep delivery.

- IPV has successfully delivered 22 Partial Exits 12 Full Exits to their investors with promising returns so far.

- Recently, IPV announced exits from 2022, registering 160% IRR

Koovers, a B2B e-commerce platform, streamlines genuine auto part supply to independent workshops and the aftermarket. With a focus on convenience and efficiency, it aims to expand its offerings and improve the automotive aftermarket supply chain. The Company is known for its diverse range of authentic parts, user-friendly ordering, and prompt doorstep delivery, thus reducing workshop downtime and enhancing efficiency. Koovers is dedicated to innovation, ensuring its customers have timely access to the right parts.

Koovers owes its success to a strong founding team whose dedication to innovation and industry expertise has been pivotal in reshaping the automotive supply landscape.

Commenting on the exit, Mitesh Shah, Co-Founder Inflection Point Ventures, says, “At IPV, we’re dedicated to working closely with founders to create lasting value. With Koovers, we went beyond the business aspect to enhance their overall market perception in a rapidly evolving sector. We’re not just advisers; we’re connectors and active partners in every business decision. We work with the founders closely to actively influence outcomes by being fully engaged throughout the journey as opposed to signing a cheque and playing a passive role.”

IPV recognized Koovers’ unique strengths and opportunities. The collaboration was designed to go beyond traditional investment relationships. IPV worked closely with Koovers to refine their strategies, shape their business model, and craft a strong fundraising and exit plan.

IPV’s commitment extended to connecting Koovers with key industry professionals, helping the Company build a network of the right professionals to guide them through a planned growth and exit map.

Sandeep Begur, CEO of Koovers, says, “IPV was a pillar for us during our fund raise and M&A stage – with Mitesh playing a pivotal role in the whole process.”

As of 2023, IPV has achieved remarkable milestones. The early-stage focused angel platform has delivered 22 partial exits and 12 full exits to their investors with promising returns so far. In 2022, IPV continued its trend of success with 12 exits, delivering a commendable 160% IRR to investors. This followed an exceptional 2021, during which IPV achieved 13 exits with a remarkable 190% IRR, solidifying its commitment to generating substantial returns and fostering the growth of promising startups.

About Koovers:

Koovers is a prominent B2B e-commerce platform specializing in supplying genuine auto parts to independent workshops and the aftermarket sector. Focusing on convenience, Koovers offers doorstep delivery. The Company’s constant goal is to improve its product range and enhance the efficiency of the automotive aftermarket supply chain, ensuring customers have access to quality parts with ease.

About Inflection Point Ventures & Physis Capital:

Inflection Point Ventures (IPV) is an angel investing platform with over 8600 CXOs, HNIs, and Professionals to invest together in startups. The firm supports new-age entrepreneurs by providing them with monetary & experiential capital and connecting them with a diverse group of investors. IPV has announced the launch of a $50 million CAT 2 AIF Physis Capital to invest in pre-Series A to Series B growth-stage startups.