New Delhi: The Enforcement Directorate (ED), a financial crime-fighting agency in India, has searched three premises of edtech company Byju’s in Bengaluru. The investigation was launched to probe possible violations of India’s anti-money laundering law. The agency revealed that it seized various “incriminating documents and digital data” during the search, which was conducted under the provisions of the Foreign Exchange Management Act (FEMA). The investigation was initiated against Byju’s based on various complaints received from private individuals, but the identities of these individuals were not disclosed.

According to the investigation, From 2011 to 2023, Byju’s received foreign direct investment (FDI) of about Rs 28,000 crore and remitted Rs 9,754 crore to various foreign jurisdictions as overseas direct investment. The ED also noted that since 2020-21 Byju’s has not prepared its financial statements and has not had its accounts audited. Therefore, the genuineness of the figures provided by the company is being cross-examined from the banks.

Byju’s legal team claimed that the searches were related to a “routine inquiry” under FEMA. The company assured the authorities that it had provided them with all the information they had requested and would continue to work closely with them to ensure they had all the information they needed. The company is confident that the matter will be resolved satisfactorily and in a timely manner.

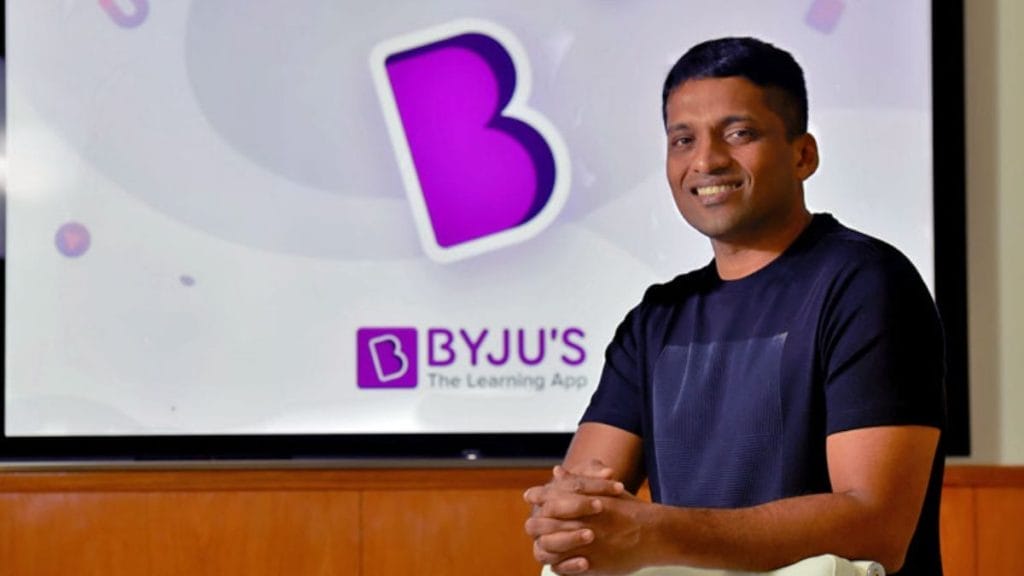

Byju’s has been facing several challenges in recent months, including pressure to cut costs, repay loans, and file its annual financial statements with regulators. The company has raised billions of dollars in the past few years, and its usage surged during the Covid-19 pandemic when schools and colleges were forced to shut physical classes, and students signed up for online learning programs. The company counts several high-profile investors, including Sequoia Capital, General Atlantic, and BlackRock, among others.

Earlier this month, Byju’s reportedly raised $700 million in a funding round, which was led by two West Asia-based sovereign wealth funds and large private equity firms. A few existing investors also participated in the round. The fundraising comes as a breather for the company, which has been working around repayments of a large $1.2-billion term loan that it secured in November 2021. However, at least two of its investors, T Rowe Price and BlackRock, have marked down its valuation. Recently BlackRock valued Byju’s around $11 billion, while T Rowe slashed its estimate of the company’s valuation to less than $10 billion.

In summary, Byju’s is currently facing an investigation by the ED regarding possible violations of India’s anti-money laundering law. The recent fundraising round comes as a breather for the company, which has been under pressure to cut costs, repay loans, and file its annual financial statements with regulators. The company’s investors have marked down its valuation, which adds to the challenges the company faces in the current economic climate.