New Delhi: Long-term investing is all about making informed decisions that can generate returns over time. Investors must focus on key financial metrics to identify potential winners in the stock market. This ensures a more strategic approach to building wealth.

In this article, we will cover what tools a long-term investor can use to make informed investment decisions.

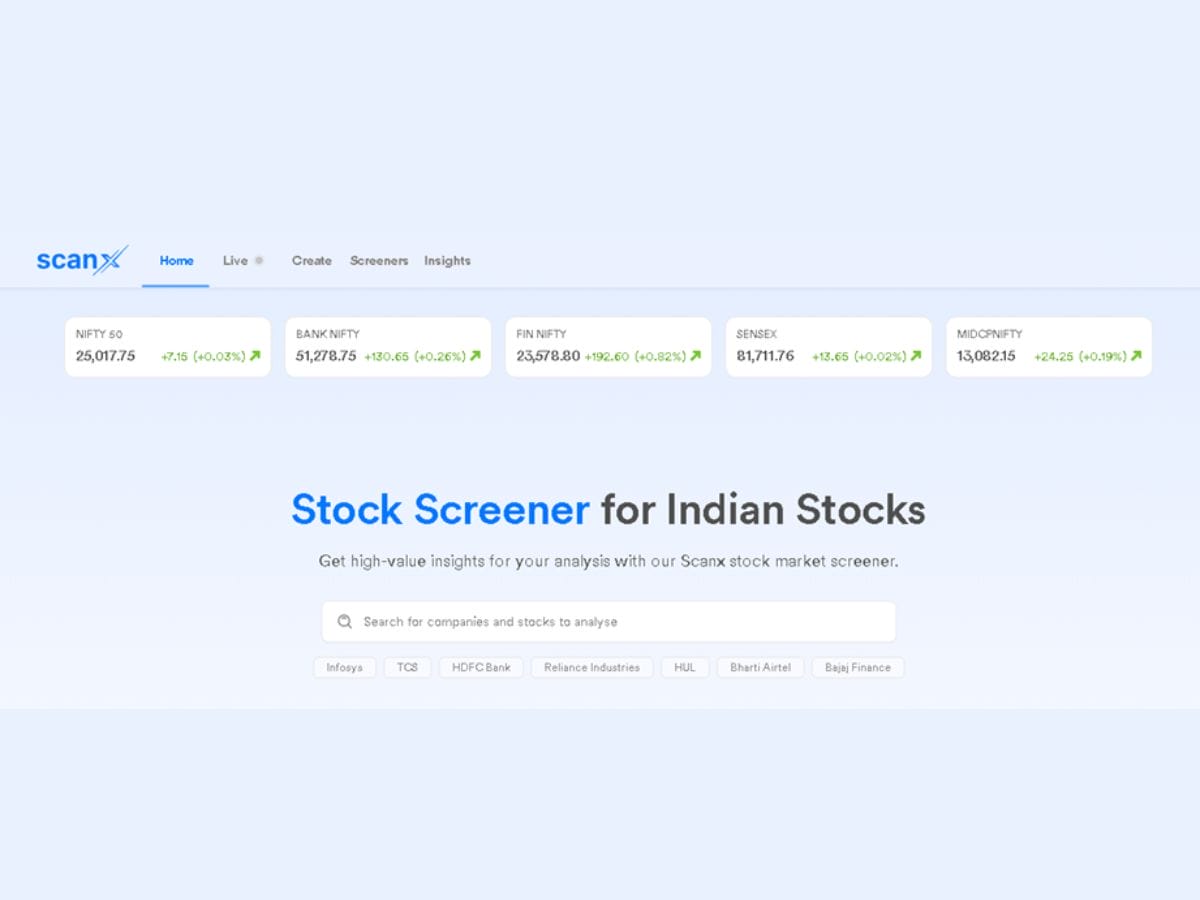

Using Stock Screener

The purpose of using a fundamental stock screener is to streamline the process of selecting stocks. You can filter them based on specific financial data that makes them potentially worth investing in.

Some of the criteria used to select stocks through screeners include price-to-earnings (P/E) ratio, return on equity (ROE), debt-to-equity ratio, alpha, and beta values.

The key purpose of using a stock screener is to save time and effort by narrowing down the choice of stocks. With a manageable list that fulfills your predefined standards, you can intelligibly pick stocks with strong fundamentals.

A Step-by-Step Guide to Using a Stock Screener

Now, let’s have a look at how to use a screener for Indian stocks.

Set Your Investment Criteria

At the outset, you must have well-defined investment criteria. Identify your risk tolerance and long-term investment goals. Are you looking for companies with strong earnings growth? Or are you more interested in those offering high dividend returns? Or maybe, you’re focussing on companies with low debt levels or high returns on equity.

When you provide specific criteria as inputs, the stocks you evaluate align with your broader investment strategy.

Provide Parameters to the Screener

Once you have set your investment criteria, the next step is to provide certain parameters to the stock screener. Most stock screeners allow investors to customize filters. You can select the metrics that matter the most to you.

For example, you might set a minimum ROE of 15%, a maximum P/E ratio of 20, and a debt-to-equity ratio below 1. When you fine-tune these parameters, you can narrow down your list of potential investments and select only the ones that fulfill your requirements.

Analyze Screened Results

Once you apply your criteria, the stock screener will generate a list of stocks that fit your parameters. The next step is to evaluate these screened results. Dig deeper into each company that finds its way into the list.

Review the key financial metrics like earnings growth, profitability, and debt levels. Also, look for companies with consistent performance and strong fundamentals. The stocks you choose must not only meet your criteria but also project a long-term growth potential.

How to Evaluate Companies Beyond the Screener?

A stock screener is an excellent starting point for investors. However, it shouldn’t be the only tool in your investment toolkit. Once you narrow down your list using the screener, it’s imperative to carry out in-depth research on each company.

Read financial reports, get a clear idea about industry trends, and get a realistic view of the competitive position of the company.

Investors should also consider qualitative factors like management quality, brand strength, and innovation. Stay abreast of news and developments that may impact the future of the company. With this holistic approach, investors can make informed decisions.

Conclusion

Now that you know why forward-thinking investors prioritize using a stock screener, you can create your own set of criteria in a custom screener. Consider your unique investment mindset as you filter stocks with strong fundamentals for long-term investment. With this approach, you can build a strong portfolio over time, investing in stocks with the potential for sustained growth.