Chennai: Edelweiss Mutual Fund, one of India’s fastest-growing AMCs, has announced the launch of Edelweiss Multi Cap Fund, An open-ended equity scheme investing across large-cap, mid-cap, and small-cap stocks. The new fund offer of the scheme will open for subscription on October 04 and closes on October 18 2023.

Key Highlights:

- India is entering into one of its best decades of prosperity, creating multiple opportunities across market caps.

- Edelweiss Multi cap fund will invest min 25% in all market cap segments to capture India’s true potential.

- Multicap Funds have a structural advantage over other categories in delivering alpha.

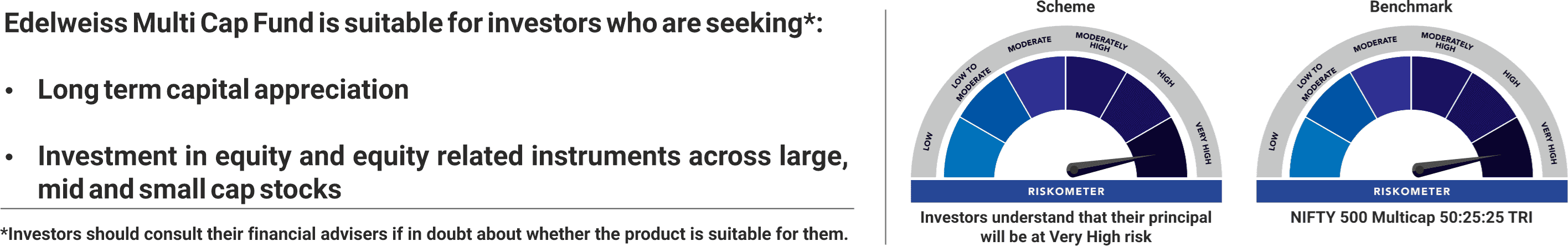

The primary objective of Edelweiss Multi Cap Fund is to generate long-term capital appreciation by investing in a diversified portfolio of equity & equity-related instruments across large-cap, mid-cap and small-cap stocks. The scheme will be benchmarked against the NIFTY 500 Multicap 50:25:25 Index TRI.

Edelweiss Mutual Fund’s investment framework assists in selecting sound companies offered at reasonable rates without favouring either value or growth investing strategies. The company will use the forensic framework and prioritize reasonably priced businesses with medium-term earnings potential. The investment approach will remain style-agnostic, focusing on well-managed companies with scalable opportunities and superior return on capital employed, aiming for sustained long-term returns.

India is set to embrace a promising decade of growth driven by a dynamic and affluent young demographic, a thriving digital economy, improving exports, infrastructure enhancements, and improved credit accessibility. We believe that our experience in successfully managing mid and small-cap strategies over the last 15 years through bottom-up stock picking will prove to be an edge while managing a multi-cap fund, which has a higher tilt towards this segment,” said Radhika Gupta, MD & CEO of Edelweiss Mutual Fund.

She further adds We have always been careful when launching NFOs and try to align with market conditions that are good for investors and can deliver value to them. Our last two equity NFOs, in the Focused and Small-cap categories, have had reasonably good returns for investors since their launch.

The fund will invest in equity and equity-related instruments, allocating a minimum of 25 per cent and a maximum of 50 per cent to each large-cap, mid-cap, and small-cap categories. The total allocation in equity and equity-related instruments, encompassing all three types, will be between 75 per cent and 100 per cent.

About Edelweiss Mutual Fund:

Edelweiss Mutual Fund is one of the fastest-growing AMCs with investment solutions across equities, hybrid, fixed income, and alternatives in India. It offers a robust platform to a diversified client base across domestic and global geographies. The fund suite is designed to provide investment solutions for investors with different needs. Edelweiss AMC has world-class knowledge platforms to provide its partners and investors with information and insights.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS; READ ALL SCHEME-RELATED DOCUMENTS CAREFULLY

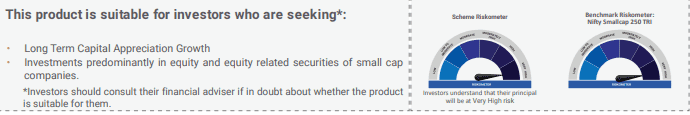

Edelweiss Small Cap Fund

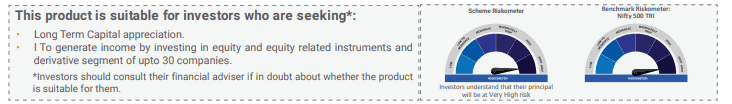

Edelweiss Focused Equity Fund

About Edelweiss Group:

The Edelweiss Group is one of India’s leading diversified financial services companies, providing a broad range of financial products and services to a substantial and diversified client base that includes corporations, institutions, and individuals. Edelweiss’ products and services span multiple asset classes and consumer segments across domestic and global geographies. Its businesses are broadly divided into Investment and advisory (Wealth Management, Capital Markets, Asset Management, and Asset Reconstruction), Credit (Retail Credit comprising Retail Mortgage, SME and Business Loans, ESOP and Margin Financing, Agriculture and Rural Finance, and Corporate Credit comprising Structured Collateralized Credit to Corporates and Wholesale Mortgages) and Insurance (Life and General Insurance).