New Delhi: Bitcoin’s price surged to its highest level in over two weeks as investor sentiment received a boost from a deal on raising the US debt limit. The leading cryptocurrency saw a 3.2% increase on Monday, reaching $28,182 and hovering around its 50-day moving average. Other cryptocurrencies like Ether and Binance Coin also experienced gains.

The debt-ceiling agreement between President Joe Biden and House Speaker Kevin McCarthy contributed to improved risk appetite in global markets. However, the deal still needs to be swiftly approved by Congress to avoid a US default. Potential headwinds include the recent rise in Treasury yields and expectations of further monetary tightening in the US.

The resolution of the debt-ceiling impasse has positively influenced risk sentiment, according to John Toro, head of trading at digital-asset exchange Independent Reserve. He noted that front-end funding costs remain high compared to crypto returns, creating a negative carry for long holders. This could continue to pose challenges for risk assets and the cryptocurrency market.

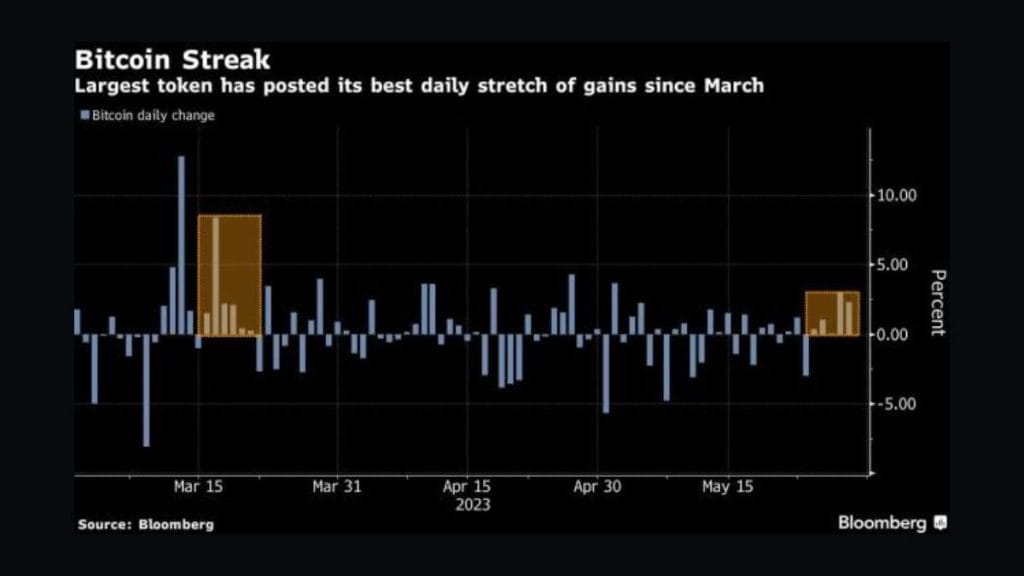

Bitcoin has been on a five-day winning streak, marking its best performance since March. This comes as a relief after a difficult quarter characterized by liquidity issues and increased regulatory scrutiny in the US.

While crypto markets have partially recovered from the slump experienced in 2022, they are still far from reaching their previous record highs. Bitcoin’s peak in 2021, for example, was nearly $69,000.

Tommy Honan, head of market analysis at crypto exchange Swyftx, suggests that the debt deal’s sense of relief may attract traders back into the market and potentially trigger a significant upward movement in Bitcoin’s price.

In conclusion, Bitcoin’s price surged to a two-week high on the back of a deal on raising the US debt limit, boosting investor sentiment. While challenges remain, such as congressional approval and potential headwinds, the resolution of the debt-ceiling impasse has provided some relief to the cryptocurrency market. Traders are hopeful that this could be a catalyst for a significant price increase in Bitcoin.