New Delhi: According to groundbreaking research conducted by BI WORLDWIDE and KANTAR, it has been found that 72% of channel partners in the Building & Construction industry in India are not engaged. This research aims to analyze the factors contributing to fostering and sustaining engagement and provide insights on building measurable and profitable brand-channel partner relationships.

BI WORLDWIDE, a global leader in loyalty and engagement solutions, partnered with KANTAR, the world’s leading marketing data and analytics company, to conduct this first-of-its-kind research. The objective was to understand what inspires, engages, and motivates channel partners in India and leverage these insights to create reliable tools for brands to understand, measure, and strengthen their channel partner relationships.

The research was unveiled at a virtual launch attended by loyalty and engagement domain leaders, market research consultants, and industry experts. It focuses on channel partners’ perspectives, highlighting key drivers of engagement, the impact of rewards, a research-based framework to measure engagement, and the communication preferences of channel partners in the new-age era.

Mr. Siddharth Reddy, Managing Director of BI WORLDWIDE India, emphasized the significance of this research, stating that it focuses on the holistic relationship between brands and channel partners. The aim was to identify the factors that affect channel partner engagement and develop a framework that enables brands to measure and optimize engagement.

Similarly, Mr. Biswapriya Bhattacharjee, Director, B2B & Technology, Insights Division, KANTAR India, highlighted the research’s uniqueness and its in-depth exploration of channel partners’ mindsets. He emphasized that brands can design effective channel loyalty programs when informed by insights from methodical and scientific research.

The research involved analyzing the behavioral patterns of over 700 channel partners across six prominent industries in India, including Agriculture, Pharmaceutical, Automotive, FMCG, Oil & Gas, and Building & Construction. Among these channel partners, 69% were distributors and retailers, while 31% were influencers such as electricians, plumbers, painters, mechanics, and daily wagers.

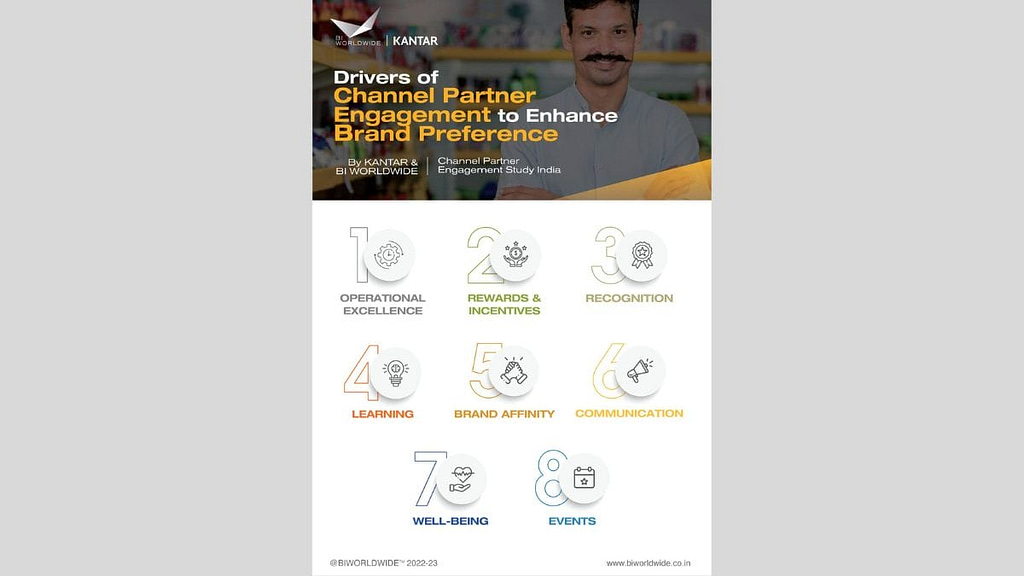

In the Building & Construction industry, which was specifically studied, the research found that a staggering 72% of channel partners were not engaged. Within this group, 62% were categorized as ‘Trapped,’ 5% as ‘Vulnerable,’ and 6% as ‘Unattached.’ The key drivers of engagement in this industry were identified as Operational Excellence, Rewards & Incentives, Learning, Recognition, Affinity towards the Brand, Communication, Well-being, and Events. Focusing on all eight drivers holistically can help Building & Construction brands foster strong and profitable channel partner relationships.

To maximize channel partner engagement, Building & Construction brands can utilize the IBC (Invest, Build, and Consider) solution framework jointly developed by BI WORLDWIDE and KANTAR. Additionally, the research revealed that 50% of channel partners in this industry preferred receiving business communication through app-based messaging platforms like WhatsApp, while 57% used social media platforms such as Facebook and Instagram.

The overall research findings indicate that a significant 78% of channel partners in India, across various industries, are not engaged. Brands can measure the strength of channel partner engagement using BI WORLDWIDE’s unique model called the Affection Matrix, developed in consultation with KANTAR. It was also observed that travel-based rewards were extremely satisfying for 68% of channel partners, followed closely by luxury rewards at 66% and business infrastructure-related rewards at 64%. To amplify channel partners’ loyalty, brands are advised to invest in a strategic mix of rewards that cover the entire efficacy scale – transactional, functional, and aspirational. Regarding communication strategies, voice, messengers, and apps are recommended mediums to consider.

This research provides valuable insights into channel partners’ expectations and equips brands with models to optimize their channel loyalty programs in India’s complex and layered market. Brands can aim for consistent revenue growth and a larger market share by focusing on engagement and building strong relationships with channel partners.