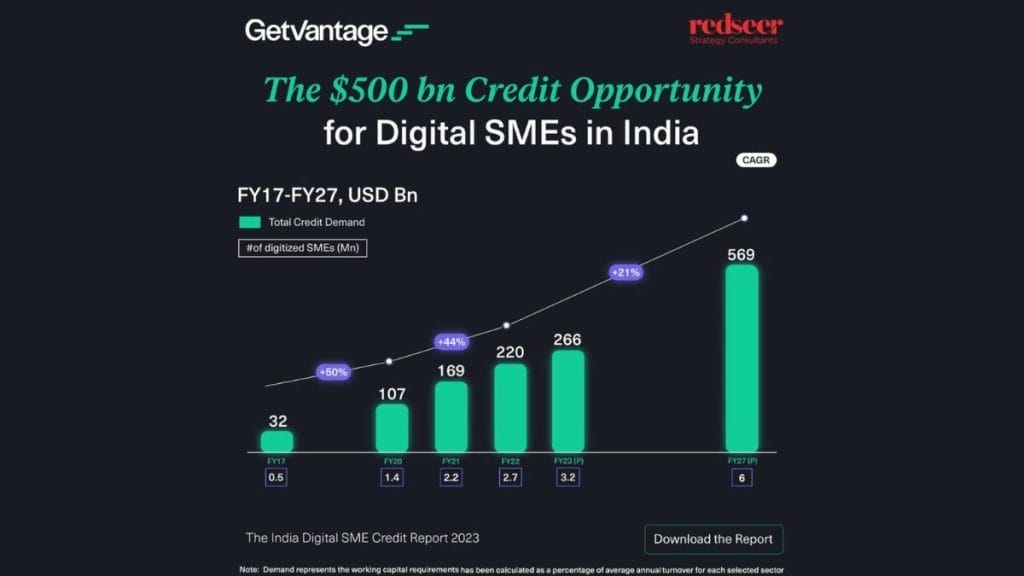

Bangalore: The India Digital SME Credit Report 2023, released today in collaboration between GetVantage and Redseer Strategy Consultants, estimates that a potential US$ 220 Bn credit deficit poses a roadblock to unlocking the economic potential of millions of digitized businesses. Out of the current US$ 220 Bn requirement (as of FY22), Redseer analysts estimate US$ 165 Bn as serviceable when adjusted for sick and commercially unviable businesses. Even after an infusion of US$ 53 Bn in FY22 into the market through various channels, the current working capital deficit stands at US$ 112 Bn. The consultants project in the report that in the next 5 years, as the number of digital SMEs doubles, the demand for credit is expected to cross US$ 570 Bn.

GetVantage is spearheading the alternative finance movement to expand working capital access to millions of SMEs and eCommerce entrepreneurs in India, taking Revenue-Based Financing mainstream.

- Digitized businesses collectively have a potential credit demand of ~US$ 220 Bn, out of which US$ 165 Bn is serviceable today.

- In the next 5 years, the credit demand for digitized SMEs is estimated to cross US$ 570 Bn

- Exploring digitally-enabled models of lending is the way forward for SMEs to solve funding challenges.

- Alternate financing solutions like revenue-based financing have emerged as a lifeline for SMEs and will grow to a $60bn+ opportunity by 2027

The deficit, according to Redseer and GetVantage, hinders new-economy and emerging businesses from innovating new products, creating jobs, scaling operations, and building efficiencies. According to Kanishka Mohan, Partner at Redseer, “Small businesses account for 90% of credit demand but continue to struggle to raise capital, owing to poor business metrics, limited assets, and uncertain growth projections. If the current economic and regulatory climate continues, this gap is likely to widen significantly over the next five years.”

The report adds that India is home to 64 Mn MSMEs, contributing to 30% of the nation’s GDP. Although the sector is a crucial growth engine for the country, it is riddled with challenges, such as limited digitization and strained access to capital that inhibit growth. According to the Redseer analysts, about 12% or 7.7 Mn MSMEs in India are digitized, and businesses that have been able to shift part of their operations online have been able to take advantage of new economic opportunities cost efficiencies and achieve scale.

While raising capital has always been a challenge for SMEs, the formal lending systems comprising public and private banks have only been able to service 30% of the overall demand, according to Redseer. The supply gap has opened up vast opportunities for NBFCs and third-party lenders, such as revenue-based financing platforms, trade financiers, etc., to serve the growing market. As a result, 40% of the overall capital investment into the SME market went to digitized SMEs (12% of total MSMEs).

Bhavik Vasa, Founder & CEO of GetVantage, adds, “India is a nation of small businesses, and modern businesses in India deserve modern capital solutions that are fair, accessible, and flexible. Alternate financing has a vital role to play in extending the limited reach of traditional lenders to serve millions of new-economy businesses and emerging sectors. The $570 bn credit requirement for digital SMEs in the next 5 years represents an unprecedented opportunity for Alternate-Financing platforms, NBFCs and traditional financial lenders (Trad-Fi) like banks to collaborate and catalyze economic growth by prioritizing compliance, governance, inclusion and innovation.”

At present, the share of alternate finance is ~5%, which Redseer estimates can double to reach ~11% in the next five years owing to alternate-financing platforms like GetVantage taking the lead to drive higher market awareness, a deeper understanding of new-age business models and needs, being tech-enabled, having an SME-first approach, integration of AI-ML to drive real-time decision-making, and high flexibility on repayments.

According to the analysts at Redseer, the lack of collateral and clear documentation has always hindered traditional lenders, such as commercial banks, to provide adequate capital to SMEs. Alternate-Finance (Alt-Fi) has emerged as a lifeline for SMEs where innovative lending models such as revenue-based financing, recurring-revenue advances, trade receivable financing, etc., are providing unrivalled access, flexibility and transparency, which are making these quasi-equity solutions ideally suited to help SMEs unlock their true growth potential.

Internet and Mobile Association of India served as an industry partner for the report.

About Redseer

Strategy Consultants Redseer is India’s largest and renowned strategy consultancy firm with a global footprint. Founded in 2009, Redseer collaborates with leaders and organizations to build thriving digital businesses. Using proprietary methodologies, deep consumer understanding, high-quality research, and an entrepreneurial mindset, Redseer offers unparalleled solutions in private equity, growth advisory, and consumer research. Headquartered in Bangalore, Redseer has a strong team of 200+ consultants in India and worldwide.

About GetVantage

GetVantage is India’s premier alternative funding marketplace & growth platform providing fast, fair, flexible, non-dilutive capital to SMEs. Launched in 2020 by Bhavik Vasa and Amit Srivastava, GetVantage facilitates frictionless, data-driven, equity-free funding between INR 20 lakhs to INR 20 crore to supercharge growth for businesses. The platform provides various non-dilutive working capital solutions for marketing, inventory, logistics, and other recurring CapEx to businesses across sectors, including B2B SaaS, eCommerce, D2C, ed-tech, cloud kitchens, and many more. The company, which has registered over 15,000+ signups on its platform, has a rapidly growing portfolio of over 650+ of India’s most exciting new-age businesses. The company is backed by leading Indian and Japanese investors, including Chirate Ventures, Varanium Nexgen Fintech Fund, Sony Innovation Fund, Dream Incubator Japan, DMI Sparkle Fund, and InCred Capital. In February 2023, GetVantage became India’s first and only alternative financing platform to have secured an NBFC license. For more information, please visit: www.getvantage.co

About Internet and Mobile Association of India

Established in 2004, the Internet and Mobile Association of India (IAMAI) is a not-for-profit industry body and the country’s only organization representing the digital services industry with over 500 Indian and multinational corporations as its members, which include established companies in diverse sectors of the digital ecosystem as well as start-ups. It is dedicated to presenting a unified voice of the businesses it represents to the government, investors, consumers, and other stakeholders. IAMAI represents varied sectors such as digital payments, fintech, digital commerce, digital advertising, digital entertainment, travel tech, online gaming, edtech, healthtech, agritech, big data, ML, AI & IoT, AR/ VR, logistics tech, D2C, EV, VC, gift cards and so on.