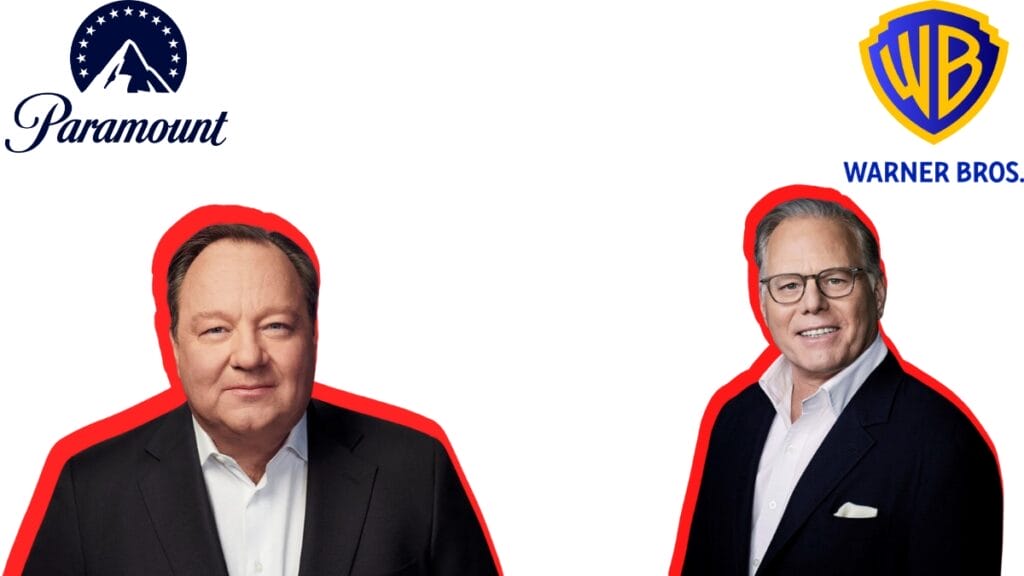

New Delhi: Warner Bros and Paramount Global are currently in preliminary discussions about a potential merger, bringing together the entities behind HBO and CNN with the studio responsible for Mission Impossible films and CBS News. The talks between Warner’s CEO, David Zaslav, and Paramount’s chief, Bob Bakish, took place during a recent lunch meeting in New York. However, insiders caution that these talks are in the early stages, and there is no guarantee that a deal will materialize. The conversation, initiated by Zaslav, is characterized more as an expression of interest than a formal offer. Paramount’s controlling stakeholder, Shari Redstone, has also engaged in initial talks with Skydance, the production company behind Top Gun: Maverick. The reported discussions with Warner Bros occur as major U.S. media companies strive to enhance profitability following an intense “streaming war” against platforms like Netflix. In an effort to mitigate significant losses incurred from their video streaming services, entertainment giants such as Warner, Paramount, and Disney are actively cutting costs. Industry analysts foresee a consolidation among smaller media firms competing against tech giants like Netflix, Apple, and Amazon for subscribers.

Warner, with its Max streaming service boasting approximately 95 million global subscribers, could potentially merge with Paramount Plus, which reported 63 million subscribers as of the third quarter. Both Warner and Paramount, with market capitalizations of $28 billion and $10 billion, respectively, face substantial debt burdens.

Warner’s net debt is $43 billion, while Paramount holds $14 billion in net debt. Both companies, equipped with extensive cable television networks, are grappling with subscriber losses due to cord-cutting and challenges in the TV advertising market. Paramount, in addition, owns the CBS broadcast TV network. Despite Redstone’s longstanding assertion that Paramount is not for sale, the recent approval of “golden parachute” bonuses for Bakish and other executives has fueled speculation about potential openness to offers. Warner’s ability to finalize a deal in the near term is constrained by the structure of the Warner Bros Discovery merger, which includes a provision preventing the company from pursuing another deal until April 8, 2024. As of Wednesday, Warner’s shares declined by 5.7% to $11.66, while Paramount’s shares fell by 2% to $15.50.